Florida Car Accident Lawyer

Our Legal Team Fights for Your Family

We see the lifelong impacts that a serious car accident can have on the lives on people every day. It’s a sad part of our job, but it also motivates us to continue doing the amazing work we’ve been doing for residents of Florida for more than 45 years. After a serious injury, your life never looks the same. You may need around-the-clock medical care. You may need to make modifications to your home to make basic daily tasks easier now that you have a disability or lack of mobility. You may not be able to work, creating the financial strain of a nightmare. Our Florida car accident attorney team can help with all of that. We’re here for you, for your loved ones, for your children.

If you’ve been in an accident, you have legal rights. We encourage you to call today for a free consultation so we can learn more about your case and ensure you understand your rights as a victim of a car accident.

Attorneys Protecting the Rights of Car Accident Victims in Florida

Our personal injury law firm also has unique resources to pursue recovery on your behalf. When we represent you, we bring to your cause:

- A team of 35 lawyers who, for more than 45 years, have helped clients obtain settlements or verdicts in automobile accident cases similar to yours;

- Medical professionals who analyze the cause of death and/or the potential for recovery from injuries;

- Investigators and paralegals whose skills have been honed in the field, sorting out auto accident details;

- A record of going head-to-head with insurance companies and other powerful corporations to fight for our clients;

- The financial resources to withstand long-term investigation and lengthy trials if necessary;

- Our pledge to keep you informed, to tell you the truth, to offer straightforward advice, and to exhaust every avenue for seeking justice.

You have legal rights and we’re here to explain them to you. It’s free to call and learn about the options available to you. Contact us today to schedule a free consultation and learn more.

Types of Negligence in Auto Accidents

In Florida, if one driver (or some other party) is negligent in causing another driver’s or passenger’s injuries, the negligent party is legally responsible for all of the victims’ accident-related losses. Some of the most common forms of negligence involved in Florida car crash cases include:

- Distracted Driving – Including talking, texting, setting GPS directions, and eating or drinking behind the wheel.

- Fatigued Driving – Including driving without adequate rest and falling asleep behind the wheel.

- Impaired Driving – Including driving under the influence of alcohol, prescription medications, over-the-counter sleep aids, or illegal drugs.

- Reckless Driving – Including following too closely (tailgating), weaving through traffic, running red lights and stop signs, and merging without looking or signaling.

- Speeding – Including exceeding the posted speed limit and driving too fast for current traffic, weather or road conditions.

- Collision – Motor vehicle collision is the most common first harmful event on Florida’s deadliest highway I-4, and an insurance institute’s research names I-4 as the deadliest highway in the United States.

- Aggressive Driving – Including speeding excessively, speeding up to “beat” red lights, passing across double-yellow lines (which can lead to extremely dangerous head-on collisions) and engaging in risky driving behaviors that present extreme risks to other motorists.

- Road Rage – Including yelling at other motorists, making threats, honking excessively, swerving at other vehicles and engaging in other all-too-common forms of road rage that create distractions and other risks for serious injury. In addition to claims for compensatory damages, road rage accidents can also give rise to claims for punitive damages and property damages, in some cases.

- Careless Driving – Including common driving mistakes such as backing up or turning without looking, which, while unintentional, still represent a clear violation of drivers’ duty of care in Florida.

- Rideshare and Delivery Accidents – Including accidents caused by Uber drivers, Lyft drivers, DoorDash Drivers, Grubhub drivers and drivers using other rideshare and delivery apps.

- Other Violations of Florida’s Traffic Laws – Along with the issues listed above, various other violations of Florida’s traffic laws can lead to serious accidents as well. When drivers violate Florida’s traffic laws, this provides clear grounds for victims and their families to seek just compensation.

Common Causes of Car Accidents

In addition to negligence, other common causes of car accidents for which compensation will typically be available include:

- Vehicle Defects – Vehicle defects can cause both accidents and accident-related injuries. We handle cases involving defective brakes, tires, seatbelts, airbags and all other types of defective vehicle components. When a vehicle defect is to blame for injuries suffered in a car accident, the vehicle’s manufacturer can be held fully liable under Florida law. While these cases present unique challenges, our firm has a long track record of success holding automakers and other manufacturers accountable.

- Inadequate Vehicle Maintenance – Along with defects from the factory, vehicle-related issues caused by inadequate maintenance can lead to dangerous accidents as well. Inadequate maintenance includes both failing to perform necessary maintenance (i.e., replacing bald tires) and performing negligent service work (i.e., a negligent brake job). Depending on the circumstances involved, either the vehicle’s owner or the shop or dealership that performed negligent service work could be liable.

- Road Defects – Road defects are a serious concern for Florida motorists as well. Potholes, sinkholes and other road-related issues can—and frequently do—cause serious accidents. If you or a loved one has been involved in a car accident involving a road defect, you could have a claim against a government agency or government contractor that breached its duty of care.

- Inadequate Warnings About Road Construction – Road construction zones can be hazardous for motorists, so adequate warnings are essential. When government agencies and road construction contractors fail to provide adequate warnings about construction zones, this can create dangerous situations that increase the risk of being involved in a serious collision.

- Safety Violations by Commercial Truckers and Trucking Companies – Many car accidents involve collisions with commercial trucks. If you or a loved one was involved in a collision with a commercial truck, the trucker or trucking company could be liable. We handle cases involving all types of safety violations by commercial truckers and trucking companies, including cases involving excessive driving hours, excessive cargo loads, inadequate truck maintenance, speeding and tailgating, and other similar types of issues.

Common Factors Leading to Car Accidents

Car accidents may be caused by a variety of factors, many of which can be linked to the negligent or otherwise wrongful acts of a defendant. If you are capable of proving that the defendant’s actions led to your injuries, then you may be entitled to recover significant damages as compensation.

Consider the following common car accident causes. If any of these causes were present during your auto accident case, call our office today for a free consultation to determine whether you may be able to pursue damages for the injuries you pursued.

Poor Weather Conditions

Many drivers mistakenly assume that, because the weather conditions are poor, they are shielded from liability in the event that they lose control of their vehicle and cause a car accident. In reality, however, drivers are held to a standard of care that is dynamic in accordance with the circumstances. If visibility is poor, for example, then the driver cannot operate their vehicle in the same manner (and at the same speeds) that they might otherwise during fair weather conditions. Failure to account for these challenging environmental conditions could expose the driver to significant liability in the event of an accident.

Let’s use a quick example to clarify.

Suppose that you are injured in a car accident collision involving another driver (during heavy rain and a thunderstorm). The defendant-driver argues that they lost control of their car due to the slick roads and rainy weather, causing them to swerve into your lane and get into an unexpected collision. You could counter this assertion by showing that, even if the conditions were poor, the defendant-driver should have accounted for the risk posed by the weather conditions and operated his vehicle at a slower speed, and with greater care. Had he done so, perhaps the collision would not have occurred.

By way of another example, suppose on a foggy Florida morning where visibility is difficult, a driver continues at the rate of speed appropriate for a clear sunny day and runs a red light because the driver was not able to see it in time to stop due to fog and the driver’s high rate of speed. As a result, the negligent driver T-bones another driver who was in the right-of-way, causing the other driver to sustain various injuries and damages. Even though fog was present as a condition that inhibited every driver’s visibility while driving that morning, the driver who ran the red light had a duty to reduce speed during the foggy conditions. Generally, when a driver runs a red light and strikes another car, the driver running the light is often at fault.

A Florida auto accident lawyer can help you evaluate whether the other driver exercised the appropriate standard of care under the circumstances.

Regarding weather conditions, FLHSMV reports reveal various weather conditions present when accidents occurred including, but not limited to:

- Blowing Sand, Soil, and/or Dirt

- Cloudy Weather Conditions

- Fog, Smog, or Smokey Conditions

- Rainy Conditions

- Severe Crosswinds

- Sleet/Hail/Freezing Rain

A Florida auto accident lawyer can help you evaluate whether the other driver exercised the appropriate standard of care under the circumstances.

RECKLESS, NEGLIGENT OR AGGRESSIVE DRIVING AND SPEEDING CAR ACCIDENTS

Reckless driving and excessive speeding often lead to car accidents and cause other drivers on the road to sustain serious injuries, some of which may be fatal. In fact, in 2023, the FLHSMV reported the following injuries caused by drivers who operated a motor vehicle in a careless or negligent manner:

Lane departure: 24,433 total accidents, 218 of fatal

Distracted driving: 8,932 total accidents, 23 fatal

Speed, aggressive driving: 3,017 total accidents, 91 fatal

Impaired drivers: 2,341 total accidents, 197 fatal

If you have been injured in a car accident where the defendant was operating their vehicle in a reckless manner or at an unreasonable speed, then you may be entitled to damages for your injuries. In fact, if they were traveling in excess of the legal speed limit for the roadway, you may be able to hold them liable for damages pursuant to “negligence per se,” which allows you to automatically find the defendant negligent for the circumstances. This can make it substantially easier to prove that the defendant is responsible for your losses. If you have questions about your rights from the injuries you sustained in an auto accident case involving a reckless, negligent, or aggressive driver, contact Searcy Denney today. For more than 45 years, we have been helping accident victims fight for their deserved compensation. Call today for a free case evaluation.

INTOXICATED DRIVING

According to statistics, intoxicated drivers (whether they are under the influence of alcohol, drugs, or some other substance) are responsible for nearly 30 percent of all traffic fatalities.

FLHSMV report indicate that alcohol-related crashes have increased in recent years:

- 2021 DUI Arrests: 43,787

- 2023 DUI Arrests: 44,185

If you have been injured by an intoxicated driver, chances are that you will be able to obtain compensation for your losses. It’s worth noting that in some cases, Florida dram shop laws may give you the right to sue and recover damages from the business and/or social host that served the intoxicated driver alcohol. Given the hidden complexity of many “drunk driving” car accident lawsuits, it’s important to consult with a qualified Florida auto accident attorney as soon as possible, so that your case can be thoroughly and timely evaluated.

FATIGUED/DROWSY DRIVING

Fatigued or drowsy driving is a serious problem, and it is a lot more common than many drivers expect. According to data gathered by the National Highway Traffic Safety Administration (NHTSA), drowsy driving in 2022 led to 693 fatalities reported to police. However, research by the American Automobile Association Foundation for Traffic Safety estimates that drunk driving causes 328,000 accidents in the United States each year, resulting in 6,400 deaths.

Many drivers mistakenly underestimate the effect of fatigue on their ability to competently operate a vehicle. In truth, however, fatigue can slow reaction times, making it significantly more difficult to avoid collisions. In extreme cases, fatigue can cause a driver to fall asleep at the wheel.

Fatigued driving is perhaps most commonly encountered in the commercial driving context, where employers overwork their drivers and provide incentives that encourage their drivers to avoid sleep and take stimulants.

While traveling on Florida roadways, especially at night, be sure to watch for signs that another driver on the road is fatigued or drowsy. Some common signs to look for to identify driver fatigue include but are not limited to:

- Wandering from lane to lane

- Continuously hitting a rumble strip

If you are able to see inside the other driver’s car or are in a car with a drowsy driver, you may also notice frequent yawning or blinking while driving. If you are injured by a fatigued commercial driver, you may have an independent negligence claim against the employer, too.

VEHICLE ROLLOVERS

Rollover accidents may be dangerous, but they are avoidable. Drivers must exercise reasonable care when inspecting, loading, and operating their vehicles to ensure that the rollover risk is kept to a minimum. Failure to do so could expose the defendant to significant car accident liability.

TEEN DRIVERS

Teen drivers can be a significant risk to others on the road. Oftentimes, teen drivers operate vehicles in a distracted or reckless manner. For example, teen drivers may become too absorbed in the music they’re listening to or too involved in a conversation occurring inside the vehicle, causing them to fail to react in time to road hazards.

According to the crash statistics from the FLHSMV’s 2022 annual report, below are statistics by age range of the drivers involved in the accidents:

- 15 to 17-year-old drivers in crashes: 13,306

- 15 to 17-year-old driver fatalities: 29

- 18 to 20-year-old drivers in crashes: 39,968

- 18 to 20-year-old driver fatalities: 108

- 21 to 24-year-old drivers in crashes: 53,653

- 21 to 24-year-old driver fatalities: 191

Fundamentally, however, the main problem that plagues teen drivers is their relative inexperience. Many teen drivers lack the requisite muscle memory necessary to make safe driving decisions during dangerous situations. They may turn too slowly or fail to make the correct decision to avoid a collision or minimize damage in the event of an unavoidable collision.

In car accidents involving teen drivers, sometimes the vehicle is not owned by the teen driver themselves, but by their parent (or even a friend), particularly when the teen is a minor. If that is the case, you may also have an independent right of action against the vehicle owner for damages, pursuant to “negligent entrustment.” If the vehicle owner knows that the teen driver is incompetent to safely operate the vehicle (i.e., unlicensed, excessive history of accidents, etc.), then they may be held liable for injuries caused by that driver after entrusting the vehicle to them. Understanding who can be held responsible for an accident caused by a teen driver is one of the many hurdles a Florida car accident attorney can help you overcome.

SENIOR DRIVERS

Eventually, advanced age can impede the physical and mental faculties of a driver to a significant enough extent that they are simply not “competent” enough to safely operate a motor vehicle. Drivers must consider their ability to safely operate their vehicle before setting forth on the road. If they are having trouble effectively navigating roadways, then chances are that they are exposing others to an unreasonable risk of injury.

ROAD HAZARDS

In some car accident scenarios, you may have a legitimate claim for damages against a property owner — public or private. Property owners have a duty to maintain their property in a reasonably safe condition for others, and this includes roadways. Failure to adequately maintain roadways (and adjacent structures) could lead to a serious car accident and expose the property owner to liability.

Consider, for example, a situation in which you are injured by a falling tree on the highway during perfectly normal weather. After further investigation, you find that the owner of the property abutting the highway did not properly inspect the trees for disease and rot. Had they done so, they would have discovered that the trees posed a dangerous falling hazard, and they could have corrected the issue by cutting down the trees or otherwise treating the disease/rot. A Florida lawyer can help you determine whether your accident was preventable and within the property owner’s duty to maintain.

What Makes Car Accident Claims Difficult to Win?

Some examples of issues our car crash attorneys handle on a regular basis include:

- Establishing liability in multi-vehicle accidents – Multiple vehicles mean multiple potential causes, multiple insurance providers, and multiple additional challenges when it comes to recovering your losses.

- Overcoming allegations of comparative fault – If the insurance companies accuse you of playing a role in the accident, you will need to overcome these allegations in order to fully recover your financial and non-financial losses.

- Dealing with uninsured and underinsured drivers – Florida has one of the highest rates of uninsured drivers in the nation, and drivers who purchase only minimal coverage often will not have the insurance required to fully cover accident victims’ losses.

- Dealing with hit-and-run accidents – Recovering after a hit-and-run accident presents many unique challenges as well. While you may be limited to relying on PIP, our lawyers may also be able to help you find another source of financial recovery.

- Establishing third-party liability – Recovering financial compensation from vehicle manufacturers, dealerships, road contractors, drivers’ employers and other third parties requires a strategic approach and skilled legal representation.

Learn What Evidence You Need to Give Your Florida Auto Accident Attorney

While there is often nothing unsuspecting drivers can do to avoid serious collisions, there generally are steps one can take after an auto accident to make sure they receive fair compensation for their losses. You can help protect your claim by following certain precautions after your car accident. Below are some important steps that all victims should try to take at the scene of the collision (assuming they are physically able to do so).

What To Do Immediately After a Car Crash in Florida

- Call 911 – Your first priority is to get immediate help for yourself or anyone injured in the crash. If you have a cell phone, dial 911. Or flag down a passing vehicle or pedestrian and ask them to call 911.

- Take Notes About the Car Accident – If you can, make notes on the circumstances of the incident, such as the time, the place, and exactly what happened. Be sure to get license plate numbers, names, addresses, and telephone numbers.

- Seek Medical Care – Go to the hospital, even if you think you feel fine. You need a physician to diagnose your medical condition and injuries from the accident, and your medical records will be key evidence in your claim for compensation.

- Write Down When You Notify Your Insurance Carrier – If you are in a car crash, insurance companies require you to file with them in a timely manner. But you are not required to accept any offers they make for reimbursement or settlement of potential car accident claims.

- Get a Copy of the Police Report – If you are to pursue any claim against the person who caused your auto accident, you will need the police report to substantiate what happened.

- Contact an Experienced Florida Auto Accident Attorney – Choosing an experienced attorney is a critical step because you are putting your future, and your family’s future, in his or her hands. You want a firm you can trust to protect your interests and represent you aggressively as you seek the justice you and your family deserve.

- Follow Your Doctor’s Orders – When seeking compensation after a car accident, it is critical that you follow your doctor’s advice. Some insurance companies will monitor claimants to see if they are going to work or engaging in strenuous activity when they should be resting, and it is important that you attend all follow-up appointments and therapy sessions to help your recovery as much as possible.

Understanding the Auto Accident Claim Process in a No-Fault State Like Florida

The car accident claim process in Florida is different from the process in most other states. This is because Florida is a “no-fault” state. This is an insurance law that requires victims to file claims with their own insurance companies in many cases.

Here is an overview of the car accident claim process in Florida when the someone else is at fault:

- File a “No-Fault” Claim with Your Insurance Company – The first step in the process is to file a “no-fault” claim with your insurance provider. This is a claim under your personal injury protection (PIP) policy. PIP covers your medical bills and lost wages up to your policy limit (which is $10,000 for most people).

- Determine if Your Injuries Qualify as “Significant” or “Permanent” – To file a claim with the other driver’s insurance company, you must be able to demonstrate that your injuries qualify as “significant” or “permanent” under Florida’s insurance law. Your vehicle collision can assist with this determination. If they do, then you can seek full compensation under the other driver’s policy (if he or she has liability coverage).

- Calculate and Document Your Accident-Related Costs – To recover the compensation you deserve, you need to prove the costs of your car accident. You do not want to let the insurance companies do this for you. Your lawyer can assist with calculating and documenting your accident-related losses.

- Negotiate for an Insurance Settlement – Whether you are dealing with your insurance provider or the other driver’s insurer, you will most likely want to negotiate for an insurance settlement. If you are able to negotiate a reasonable settlement, then you will receive an insurance company payout.

- Take Your Case to Court if Necessary – If you are not able to obtain a fair payout through the settlement negotiation process, then you will need to take your case to court. Not only does hiring an experienced car accident lawyer give you the best chance of obtaining a fair settlement, but it also ensures that you will be prepared to go to court if necessary.

How to Strengthen Your Auto Accident Claim

If you have been injured or lost a loved one in a motor vehicle accident, what do you need to know? What do you need to do? What can you expect over the weeks, months and years to come? How can you make sure the insurance companies do not take advantage of you?

- Avoid Speaking with an Insurance Agent – You likely will need to speak with your insurance team immediately following an accident, but you should do your best to avoid any communication beyond initially filing a claim.

- Avoid Discussing the Accident – A big part of staying quiet after a car accident is not posting on social media. As your car accident lawyers, we recommend you not speak to anyone about the details of your accident – and definitely stay off social media.

- Write Down What You Remember – In high-stress situations we often forget the details. We have worked with many clients who struggle to recall the basic events of their accident after time has passed. A great way to overcome memory loss due to trauma or time is to journal and document your recollection of events, and your feelings about them in a diary.

The Importance of Hiring a Florida Car Accident Law Firm to Deal with Insurance Companies

Insurers are best avoided until you secure the assistance of a qualified attorney who will speak on your behalf — in the car accident context and otherwise. If you have been injured in a car accident, it’s important not to speak to your insurer or the defendant’s insurer. Beware that any statements you make to insurers will be recorded (or otherwise documented) and used against you. For example, if you speak to a representative of the defendant’s insurance carrier, and you casually admit that you may have been at least partially at fault for the accident, then they will argue that your potential recovery is limited. When speaking directly to the other party’s insurance carrier, extreme caution should be taken. Take the pressure of speaking to an insurance company after the trauma of a serious accident off your plate and let an experienced auto accident attorney at Searcy Denney negotiate with them on your behalf.

Uninsured Motorist Accidents

Uninsured motorists are quite common in Florida. If you have been injured by an uninsured motorist, you may find that your options for recovery are somewhat limited because the defendant-driver lacks the insurance coverage (and likely the personal assets) necessary to cover your various losses. First-party insurance coverage can account for your losses under such circumstances, but if you lack such coverage, then you may want to investigate the possibility of other liable third parties, such as the defendant’s employer, a property owner (who created a road hazard), or even the auto manufacturer if a part was defective.

WHAT IS UNINSURED AND UNDERINSURED MOTORIST COVERAGE?

Uninsured motorist coverage (UMC) is an important type of car insurance coverage that can help pay for damages you sustain if you or those in your vehicle are injured in an accident caused by another driver who does not have automobile liability insurance. UMC may help cover damages you sustained by an uninsured motorist for damages such as medical bills, lost wages, and pain and suffering, among others. Additionally, in some states, you may also be able to purchase coverage for property damage caused by an uninsured motorist.

Underinsured motorist insurance coverage is another type of insurance coverage that can help pay for damages caused by another motorist in a car accident whereby the other driver does not have sufficient liability insurance to cover the damages you sustained from the accident.

WHY YOU SHOULD SAY YES TO UNINSURED MOTORIST COVERAGE IN FLORIDA

Although most states require drivers to carry automobile liability insurance before driving on the road, there are still many motorists who choose to drive on a public roadway without sufficient insurance coverage or any insurance coverage at all in clear violation of the law.

A 2023 study conducted by the Insurance Research Council indicates that about 14% of U.S. motorists – or about one in every seven – were uninsured in 2022. This is an increase from 11.16% in 2017 and means that an estimated 35.7 million motorists are driving without insurance. The end result is costly in terms of lives and money: More than 12% of vehicle accidents involve uninsured drivers, and the cost of damage nationwide each year is estimated at $28 billion. Drivers of older cars are especially negligent: A whopping 40% of vehicles older than 15 years are driven by uninsured drivers.

In addition to the above statistics, below are additional statistics from 2016, an earlier study by the IRC:

- Insured drivers paid approximately $78 per insured vehicle for insurance coverage protecting against at-fault drivers who are uninsured or uninsured.

- Insured drivers paid more than $13 billion for uninsured/underinsured motorist coverage.

- In the United States, uninsured motorist rates varied substantially across states ranging from 3.1 percent in New Jersey to 29.4 percent in Mississippi.

If you live in Florida, your odds of encountering an uninsured driver are even greater than the national average. That’s because 3.2 million motorists – about 26.7% of Florida’s licensed drivers – do not carry bodily injury insurance. What’s more, many drivers are underinsured, because Florida law does not require motorists to carry uninsured or underinsured motorist coverage.

Why do some motorists choose to drive without auto insurance coverage? Some may simply choose not to purchase auto insurance in knowing violation of the law. Others may not be able to afford auto insurance but must drive on the roadway as a matter of survival (such as to go to and from work). There may also be an unintentional situation where a driver accidentally missed a renewal date to renew their auto insurance policy. Whatever the reason a motorist does not procure appropriate insurance coverage before they enter a Florida roadway, there are serious consequences for other drivers on the road who are law-abiding citizens and who have procured the proper auto insurance coverage.

Drivers who do abide by auto insurance laws must absorb the cost of the damages caused by an uninsured motorist in the form of paying for uninsured motorist coverage. This means that in addition to being responsible and paying for insurance coverage for accidents that they may cause on their own, they also must absorb the cost of damages caused by others when they were negligent both in causing an accident and not carrying appropriate insurance coverage.

What does it mean for you and your family when every eighth driver you pass on the street or highway does not carry sufficient coverage to fully compensate you if he or she should cause a crash in which you suffer devastating injuries?

It means that when you buy new auto insurance or renew your current policy, you should say “yes” to UMC coverage. If you do not purchase sufficient UMC, then you can be the one “left with holding the bag” and sustain substantial damages from an auto accident that was not your fault. UMC can help protect you in the unfortunate event that you are hit by an uninsured or underinsured motorist.

COLLECTING FROM YOUR PIP POLICY

If you or a family member is involved in a car crash with an uninsured driver and you don’t have UM coverage, you lose your ability to recover for future medical expenses, lost wages, and non-economic damages such as lifelong disability and pain and suffering. Your health insurance and Personal Injury Protection (PIP) only pay the bills you have received for the extent of your injuries today, not for any future losses attributed to this accident.

That’s why many insurance companies will try to discourage you from buying UM coverage – it forces them to pay for the full extent of your losses.

Buying automobile insurance is a confusing and frustrating process, one for which you should be thoroughly prepared and armed with specific questions to ask your insurance agent.

Under Florida’s hybrid no-fault insurance system, the law requires drivers to carry Personal Injury Protection (PIP), which compensates the insured driver and household members for medical treatment regardless of who is at fault in an accident. PIP covers the costs of medical treatment, lost wages, and incidental costs associated with medical care – but not pain and suffering or future medical care, future loss of earnings of loss of future earning ability, or disability. PIP coverage is usually limited to $10,000 in medical and disability benefits and $5,000 in death benefits resulting from bodily injury or death stemming from ownership, maintenance or use of the insured motor vehicle.

WHAT IS BODILY INJURY LIABILITY COVERAGE?

Bodily injury liability coverage provides coverage for claims made against you for the accidental bodily injury of other parties injured in a crash involving an insured motor vehicle. The named insured and family members are excluded from this coverage. Florida law does not require that bodily injury liability coverage be purchased or carried. Accordingly, a great many Florida drivers are uninsured or underinsured if they cause an accident resulting in bodily injury to another person. So, if you are injured in a traffic accident with one of the 24% of Florida drivers who do not carry this bodily injury liability insurance, your recovery is limited to your own PIP coverage, unless you yourself have an Uninsured Motorist policy.

Ask your insurance agent whether his or her company offers both “stacked” and “un-stacked” UM coverage. The difference between stacked and un-stacked coverage can affect whether or not you or your family members will be able to collect UM at all.

In Florida, if you elect to carry bodily injury liability insurance, the law requires that the insurance company also provide Uninsured Motorist coverage unless you expressly reject it. Florida Statute 727.727(1) reads:

No motor vehicle liability insurance policy which provides bodily injury liability coverage shall be delivered in this state with respect to any specifically insured or identified motor vehicle registered or principally garaged in this state unless uninsured motor vehicle coverage is provided therein or supplemental thereto for the protection of persons insured thereunder who are legally entitled to recover damages from owners or operators of uninsured motor vehicles because of bodily injury, sickness, or disease, including death, resulting therefrom. However, the coverage required under this section is not applicable when, or to the extent that, an insured named in the policy makes a written rejection of the coverage on behalf of all insured parties under the policy.

Stackable Insurance Coverage

By law, insurance consumers must be fully advised of the nature of UM coverage and further notified that the coverage will be equal to the insured’s bodily injury liability limits on a stacked basis unless lower limits are requested or the coverage is rejected. Stackable coverage means that the uninsured motorist coverage on multiple vehicles covered under one policy can be increased by stacking the coverage. For example, if the policy provided stacking uninsured motorist coverage of 100 per person /300 per incident, on each of three vehicles, then the total coverage available for injury caused by an uninsured or underinsured motorist would be 300 per person / 900 per incident. You may reject this coverage entirely, reject just the stacking feature, or choose lower limits, as long as your rejection or selection of lower limits is made on an approved form.

Stacked UM insurance usually costs more, but it provides broader coverage. Most insurance companies offer both versions, but they may not tell you that – or explain the similarities and differences. The bottom line is, you should carry stacked Uninsured Motorist coverage to make sure that you and your family have the broadest protection – anywhere, anytime, in any vehicle – if you are injured in an accident with an uninsured motorist.

When Can You Seek Coverage Outside of PIP?

Florida’s no-fault insurance law limits the circumstances in which accident victims can seek coverage outside of PIP. Specifically, in order to file a claim under an at-fault driver’s bodily injury liability policy, you must be able to prove that you have suffered either a “significant” or “permanent” injury. The law identifies three types of injuries that fall into these categories:

- Significant and permanent loss of an important bodily function (i.e. loss of eyesight or mobility);

- Significant and permanent scarring or disfigurement (i.e. permanent scarring due to burns or a protruding bone fracture); and,

- An injury other than scarring or disfigurement that is likely to be permanent, “within a reasonable degree of medical probability.”

What the Insurance Company Doesn’t Want You to Know

Unfortunately, despite what they say in their advertisements, the insurance companies are not on your side. They are not going to be there for you, and they are not going to help make sure you receive the compensation you deserve. In fact, when you have an insurance claim, the insurance company’s goal is to minimize the amount it has to pay. With this in mind, here are five important facts the insurance companies don’t want you to know:

- You Have the Right to Say “No” to Giving a Recorded Statement

When you file an insurance claim, the adjuster will ask you to explain what happened. Your statement will be recorded; and, if you say anything that could negatively impact your claim, the insurance company will use it against you. However, you are not required to give a statement; and, generally speaking, you should not do so.

- The Insurance Companies Do Not have to Tell You What Your Claim is Worth

When you have an insurance claim, it is up to you to determine how much you are entitled to recover. If you don’t know, the insurance company isn’t going to figure it out for you. As a result, any settlement offer you receive is going to reflect the company’s own best interests, and this means that it will almost certainly reflect just a small fraction of the true amount you are entitled to recover.

- Most Represented Accident Victims Recover Far More than the Insurance Company’s Initial Offer — Especially with the Help of a Florida Car Accident Law Firm

Hiring a law firm to handle your insurance claim can drastically change the outcome. Once the insurance companies know you are represented after your car accident, they will handle your claim differently, and they will not be able to get away with many of the tactics they use against unrepresented claimants.

- The Insurance Company is Required by Law to Handle Your Claim in Good Faith

Under Florida law, insurance companies are required to handle all claims in good faith. Unfortunately, many do not, and many claimants fall victim to bad-faith insurance practices. If your insurance company denies your claim in bad faith, then not only are you entitled to coverage, but you are entitled to additional compensation for the losses you incur as a result of the company’s bad-faith insurance practices.

- Once You Accept an Insurance Settlement, Your Claim is Over

Once you accept an insurance settlement, that is the end of your claim. You cannot go back to the insurance company and ask for more. The insurance companies don’t want you to know this; and, if you are not represented by a car accident law firm, they will try to get you to settle for much less than you deserve.

Car Accidents with Out-of-State Drivers

If you have been injured in a car accident with an out-of-state driver, your case may have some unique challenges that are typically of no concern in collisions involving in-state drivers. Nonetheless, such collisions can involve minor injuries, serious injuries, or even death, and you can still bring a claim for financial compensation against an out-of-state at-fault driver. At Searcy Denney, we can handle every aspect of your car accident claim, so you can just focus on your recovery.

What Do I Need to Know About Car Accidents with Out-of-State Drivers?

If you have been injured in an accident caused by an out-of-state driver, there are a few things you should know:

- The out-of-state driver may be difficult to locate or communicate with once they return to their home state.

- If you need to file a legal claim, it may be an issue to serve the out-of-state driver with the complaint and other types of legal paperwork, such as discovery requests or subpoenas.

- The out-of-state driver may be uninsured or underinsured.

However, all of these issues can be overcome. The Florida car crash lawyers at Searcy Denney are experienced with these types of jurisdictional issues and understand the methods needed for holding out-of-state drivers accountable.

How Florida Laws Apply to Out-of-State Drivers

Driving in another state creates an implied agreement to follow that state’s laws. Consequently, out-of-state drivers can be held liable according to the same negligence standards as native Florida state drivers. Still, there is always a set of rules in place at the time of an accident, and our Florida auto accident lawyers know and thoroughly understand them. Our team can handle your insurance claim and any legal claims you may have in a way designed to get you the most lucrative financial compensation possible, whether the accident was with an out-of-state driver or not. It should be noted that ignorance of the law, which an out-of-state driver may claim, is no defense for violations of Florida’s laws.

Florida Crash Statistics

The Florida Highway Safety and Motor Vehicles (FLHSMV) reports motor vehicle crash data and other statistics each year; the Florida Department of Transportation (FDOT) maintains a Florida Crash Dashboard for easy access and updates these reports annually. The most recent data available indicates that in 2024 there were about 15,000 fewer Florida motor vehicle crashes than in 2023, and about 3,000 fewer crashes that resulted in fatalities.

2024 Florida Car Crash Statistics

- All Crashes: 380,308

- Total Fatal Crashes: 2,887

- Total Injury Crashes: 160,583

- Total Bicycle Crashes: 9,294

- Total Bicycle Fatalities: 195

- Total Motorcycle Crashes: 9,420

- Total Motorcycle Fatalities: 578

- Total Hit and Run Crashes: 97,635

- Total Hit and Run Fatalities: 238

2023 Florida Car Crash Statistics

- All Crashes: 395,175

- Total Fatal Crashes: 3,162

- Total Injury Crashes: 164,413

- Total Bicycle Crashes: 8,418

- Total Bicycle Fatalities: 234

- Total Motorcycle Crashes: 9,548

- Total Motorcycle Fatalities: 621

- Total Hit and Run Crashes: 105,092

- Total Hit and Run Fatalities: 276

2022 Florida Car Crash Statistics

- All Crashes: 388,961

- Total Fatal Crashes: 3,188

- Total Injury Crashes: 160,075

- Total Bicycle Crashes: 7,090

- Total Bicycle Fatalities: 207

- Total Motorcycle Crashes: 9,085

- Total Motorcycle Fatalities: 585

- Total Hit and Run Crashes: 104,774

- Total Hit and Run Fatalities:266

Updates and prior year reports can be found on the FLHSMV’s Crash and Citation Reports page.

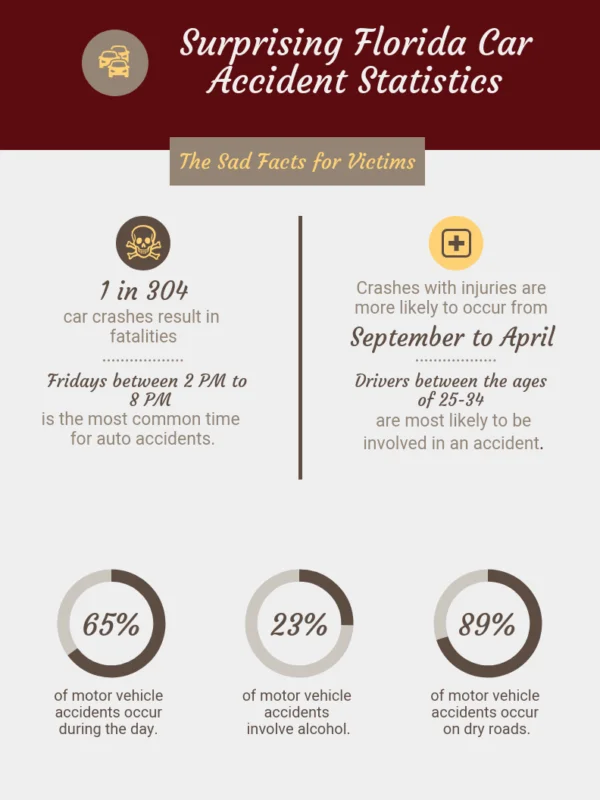

Car accidents and injuries can happen in all types of car wrecks. Below is an infographic created by a Searcy Denney Florida auto accident attorney, revealing some surprising data about accidents in the Sunshine State:

Case Results from Our Florida Car Accident Lawyers

What Is the Average Auto Accident Settlement in Florida?

Our experienced attorneys have been representing victims of accident claims for more than 45 years. We have an impressive track record of success. Some notable car accident case results include:

- $10 Million Verdict for Injuries Caused in Multi-Vehicle Accident

- $1 million settlement for neck injuries suffered for years after traffic accident

- Award of $1 Million for Massive Injuries Caused by Speeding SUV

- Confidential Settlement in Man’s Death in Horrifying Multi-Vehicle Crash

Read about our other vehicle accident case results.

Contact a Florida Car Accident Lawyer to Discuss Your Motor Vehicle Crash Claim

If you or a family member has been injured in an auto accident and you want to discuss a potential claim, schedule an appointment with an experienced Florida car accident attorney. You can contact us online or call us at 800-780-8607 to arrange for your free, confidential consultation at our Tampa, West Palm Beach or Tallahassee office. No recovery, no fee.

FAQs

What if the other driver doesn’t have insurance?

If the driver who hit you was uninsured, you will need to discuss the specific facts of your case with an attorney to determine what legal options you have available. While one option is certainly to file a claim against the driver personally, if the at-fault driver was uninsured, he or she is unlikely to have the financial resources to pay just compensation for your losses.

As a result, in most cases involving uninsured drivers, we need to explore alternative sources of compensation. One of these sources may be your own auto insurance policy. If you have uninsured/underinsured motorist (UIM) coverage, then in addition to your Personal Injury Protection (PIP) coverage, you may also be able to collect the compensation that you would have been paid by the at-fault driver’s insurance company.

Another option is to identify another party that is responsible for your losses. This could be the case if, for example, your brakes failed or you were injured when one of your airbags deployed improperly. If a hazardous road condition (such as a pothole, blind curve or low shoulder) played a role in the accident, then the highway authority may be responsible for your losses as well.

An insurance company is offering me a check. Should I take it?

No. If you have received a settlement offer without legal representation, the offer is almost certainly for far less than the true value of your claim. The insurance company is trying to get you to settle before you have had the opportunity to make an informed decision. In addition, by accepting the check, you could be waiving your right to seek additional compensation. Before accepting any money for your injuries, it is critical that you find out exactly what your case is worth from an experienced Florida auto accident attorney.

What if the auto insurance company is refusing to pay for my injuries?

If you have been unsuccessful in securing payment from the insurance companies, you will need to hire an auto accident attorney to help. The insurance companies routinely deny unrepresented accident victims’ claims for compensation; and, when they offer payment, it is usually because they are trying to settle for less than the full amount owed. It is not too late to seek help, but you do not want to wait any longer than necessary to seek legal representation.

Will my insurance rates increase after an accident?

It depends. If the accident was 100 percent someone else’s fault, your rates should not increase. On the other hand, if you were partially at fault or if you need to file a UIM claim, then your accident could affect your premiums. This is yet another issue you will want to discuss with a car accident lawyer so that you can make an informed decision about protecting your legal rights.

How much does an attorney charge for a car accident in Florida?

You should not have to pay anything out-of-pocket to hire experienced auto accident lawyers. A reputable legal team will represent you on a contingency fee basis. With contingency fees, there are no retainers or monthly legal bills, and you don’t pay anything unless your lawyer helps you recover just compensation.

If your lawyer helps you recover just compensation, your legal fees will be calculated as a percentage of your settlement or verdict. Your lawyer should disclose this percentage to you upfront, and there should be no surprises when it comes to the legal fees you have to pay out of your award. At Searcy Law, we will explain our legal fees before you hire us, and if we receive a settlement offer on your behalf, we will let you know exactly how much you will take home so that you can make an informed decision about whether to accept.

Do I need a lawyer after a car accident?

If you’ve suffered serious injuries in a car accident, the aftermath can be a difficult time, with medical bills and lost income only part of the picture. With far-reaching consequences, including chronic pain and diminished quality of life, seeking maximum compensation often requires legal representation. Searcy Denney’s car accident attorneys bring decades of experience and a proven track record in securing substantial settlements and litigation victories. With unique resources and a commitment to transparency and justice, our attorneys protect victim rights and fight for their fair compensation.

How long do you have to get a lawyer after a car accident in Florida?

Due to a change in the law enacted in 2023, you generally only have two years to file a lawsuit after you are injured in a car accident in Florida. However, you do not want to wait anywhere near this long to hire a Florida car accident lawyer. Instead, you should hire a lawyer as soon as possible—as your lawyer will need to conduct an investigation before any evidence of liability disappears.

When you are entitled to financial compensation for a car accident in Florida, any unnecessary delays can be costly. Even if you haven’t run out of time to file a lawsuit, you may find it much more difficult to recover the financial compensation you deserve. For this reason, we encourage all auto accident victims to contact us right away.

How long does an insurance company have to pay a settlement?

The insurance companies do not have a deadline to pay a settlement in Florida. While the insurance companies must handle all claims in good faith, they do not have to offer a settlement by a certain date (or even offer a settlement at all). Additionally, as a car accident victim, the timeline of your claim also partially depends on you. The sooner you hire a lawyer to represent you, the sooner you can begin making informed decisions while relying on your personal injury lawyer to negotiate on your behalf.

What is the 90-Day Rule in Florida Insurance?

The 90-day rule in Florida insurance states that insurance companies must make their coverage determinations within 90 days of receiving a claim unless they cannot do so due to factors beyond their control. However, this is the old rule—and it no longer applies to car accident claims as of March 1, 2023. Under the new rule in Section 627-70131(7)(a) of the Florida Statutes, this time window has been reduced to 60 days. In addition to making coverage determinations within 60 days, insurance companies must also pay undisputed amounts within this time period.

Can I Still File a Personal Injury Claim If I Was at Fault in the Car Accident?

If you were partially at fault in the accident, you may still have options under Florida law. For example, if you were 10 percent at fault, you would still be entitled to recover 90 percent of your losses. In Florida, if the injured party is found to be more at fault than the defendant, then they cannot recover damages.

However, establishing fault requires a thorough investigation and reasoned legal analysis, and it is one of the most common issues leading to litigation. While you may think you were the at-fault party, the evidence may suggest otherwise, and you should not rush to judgment until you have discussed your case with an experienced car accident law firm.

How Long Do I Have to File a Car Accident Claim in Florida?

In most cases, the statute of limitations for car accident claims in Florida is two years. If you do not file within two years, you could lose your rights entirely.

However, much shorter delays can jeopardize your case as well. For example, if you wait too long to seek legal representation, your car accident lawyer may not be able to collect certain key evidence (such as skid marks) from the scene. Without legal representation, you also run the risk of saying something you shouldn’t to the insurance companies. As a result, while you may technically have two years to assert your rights, we strongly recommend that you speak with an auto accident attorney as soon as possible.

What if the Driver is from Out of State?

Here in the Sunshine State, we have a lot of out-of-state drivers, and a Florida auto accident attorney is happy to assist with these claims. If you were injured by an out-of-state driver, your case will largely be similar to one involving a claim against a Florida resident. There may be some additional steps involved if your case goes to trial, but it is much more likely that your case will settle long before that comes into play. Even with the similarities, it’s best to speak with a car accident lawyer to make sure the proper procedure is followed.

Am I Entitled to Financial Compensation for my Future Medical Expenses?

Yes. After a car accident resulting from someone else’s negligence, in addition to compensation for your outstanding medical bills, you are also entitled to compensation for your future medical treatment, but there are limits, and these numbers vary based on your particular circumstances. Your Florida auto accident attorney can help determine what future care expenses you may be entitled to.

Can My Florida Auto Accident Attorney Argue for Pain and Suffering Damages?

Potentially, yes. In cases involving serious traumatic injuries with long-term or permanent effects, victims will often be entitled to financial compensation for the non-financial impacts of their injuries. This includes pain and suffering, as well as losses such as:

- Emotional trauma

- Scarring and disfigurement

- Loss of enjoyment of life

- Loss of society, support and services

- Loss of companionship and Loss of Consortium

Depending on the extent of your injuries, our qualified attorneys would fight for all non-economic damages relevant to the car accident.

How Will My Car Accident Attorney be Paid?

Our accident attorneys are paid via contingency fees. So, what does this mean for you?

- You will get a no-obligation, free initial consultation

- There are no retainer fees, and we do not charge hourly rates

- You pay nothing while your case is pending

- We only keep a fixed amount of the compensation we recover on your behalf

- You pay nothing unless we win