The Insurance Industry War on Justice

Did you know that the day you were injured, through the negligence of another, you entered a potential red zone? Did you know that your ability to get treatment and compensation may rely on the competence and honesty of insurance company employees?

The insurance industry has spent billions of dollars over the past 30+ years to spread and foster false and misleading information about injury claims.

The insurance industry needs people to believe that the justice system is out of control.

The insurance industry needs the public to believe that people who file lawsuits are getting millions of dollars for minor injuries.

The insurance industry needs you to believe that there are no checks or balances in the judicial system to guard against the flood of “frivolous” law suits.

This is nothing more than propaganda, canards, untruths …in plainer language, lies. The key to propaganda is to make the message simple; give people “someone” to blame; and repeat the message over and over, again and again.

Propagandists will typically select a single isolated event, (such as the McDonald’s case) to represent the idea that insurance companies and corporations are the real victims. Certain facts will be selected to include in the propaganda, but not all the facts; only enough information to paint just the picture they want the public to see. These repeated messages create the false perception among the public that the system needs fixing. Unfortunately, this “misinformation” spread by the insurance industry has had a noticeable and negative influence on juries and their verdicts.

Many jurors today are highly skeptical of people who file lawsuits that claim money for “pain and suffering.” Most jurors have never had an occurrence in their lives that caused them to come into contact with the civil justice system; it is foreign territory for most jurors. That is until they are selected for jury service.

Many people who are selected to serve on juries have been unconsciously influenced by the barrage of propaganda disseminated by insurance companies, they don’t mean to, but they already have their minds made up when they sit on the jury. Regardless of the Court’s instructions to weigh the evidence and to follow the law, they have been influenced by the propaganda campaign. This throws a “monkey wrench” into the way the judicial system is supposed to work and can be a huge obstacle to seeing justice done in a given case. Subconsciously, even when the injuries are catastrophic, the negligence is clear, and the evidence is before jurors, that subliminal message from insurance companies and corporate America, repeated over and over, begins to influence them.

Insurance is a business; they want to make as much profit as they possibly can. There is nothing wrong with that in the most pristine sense. The problem develops when the drive to generate profits gets in the way of promises made to consumers.

An educated consumer should be aware that the insurance claims adjustor might be motivated to pay out as little as possible on a claim, even on legitimate claims that involve serious injuries. Insurance companies train adjustors how to save the company money. Unfortunately, too often, the promises to policy holders and the desire to save money get in the way of each other.

Insurance companies interested in how much money they save, rather than how many claims are fairly settled may motivate adjusters to accomplish his goal in several ways:

Using Delay to wear people down. Many people will, at some point, tire of the fight and decide that enough is enough! Time is on the side of the insurance company. They are not worried about next week’s groceries, or whether you’ll soon be able to return to work at full pay. They know that many will not reach the finish line, give up, and accept the company’s last offer just to be done with the whole process.

Requesting Unnecessary Information is another method to delay. This is when the adjustor makes repeated requests for “documentation” even if the information will have little or no bearing on the claim or the amount that will be offered in settlement. Repeated requests for unnecessary documentation can easily frustrate people and wear them down so they’re more likely to accept a lower settlement offer.

Disputing the Medical Treatment. The adjustor may try to minimize your claim by disputing your need for medical treatment, despite having no medical training! This is true in many cases even if the treatment is prescribed by your own doctor, a reputable licensed physician.

Nickel & Dime the Medical Charges. The adjustor may only agree to “accept” 70, 80 or 90% of your past medical charges, while having no medical background to support such a position. By “nickel and diming” the consumer, the adjustor knows that most people will not hire a lawyer to challenge a small portion of the medical bills.

Tell You Not to Hire an Attorney. Other times the insurance company may attempt to dissuade you from hiring an experienced attorney, falsely advising that any money you receive will go only to pay the attorney’s fees, and your “net recovery will be the same today as it would be with a lawyer representing you and resolving the matter years down the road. You will hear things like: “a lawyer will just delay everything”; “an attorney will just make it harder to pay your claim”; or “if you hire an attorney, we will not continue to handle your claim quickly”. The adjustor could also threaten to “deny” or “lowball” the claim if you hire a lawyer.

Misrepresenting Insurance Policy Benefits. The adjustor may misrepresent the amount of insurance coverage that is available to you or not tell you that the insurance coverage or certain types of benefits even exist. This tactic may also be used to entice you into accepting a smaller settlement than what would otherwise be warranted, by characterizing your claim settlement as a “gift”.

Acting as Your Friend. There are times when the claims adjustor will “befriend” you. Insurance companies remind you that you are in good hands, or that you’ll be treated like a good neighbor, or that you will be protected under their umbrella. They may make it appear they are watching out for your best interests.

Making False Promises. The adjustor will make promises that he or she knows can’t be met. For example, an injured person was promised that the insurance company would continue to pay medical bills every month until complete recovery. This went on for a few months until the adjustor decided that a few months of treatment was enough. The problem was that the client didn’t find out about the insurance company’s decision to stop paying until she had racked up many more months of medical bills!

These are just a few of the tactics that the insurance industry uses to badger and wear down injured victims so that less money is paid out. To a large extent, the industry has been successful with their misinformation campaign. The strong backlash created by the insurance industry against our justice system has become a very strong movement in many parts of our country. The movement has a name, it is called Tort Reform. The success of the Tort Reform movement has emboldened the insurance industry to withhold fair settlements until you convince them that you are ready, willing and able to go to trial.

What is Tort Reform?

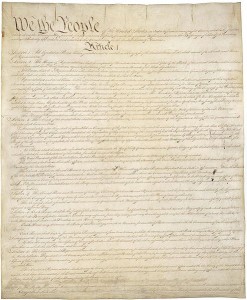

Tort Reform is a violation of your Constitutional Rights. The Seventh Amendment found in the Bill of Rights, promises every citizen the right to a trial by jury :

In suits at common law, where the value in controversy shall exceed twenty dollars, the right of trial by jury shall be preserved, and no fact tried by a jury shall b e otherwise reexamined in any court of the United States, than according to the rules of the common law.

e otherwise reexamined in any court of the United States, than according to the rules of the common law.

This was not placed into the constitution lightly. It was intended to protect citizens from being taken advantage of by those having more power or social standing. Efforts to place caps or limitations on jury awards or to force disputed claims to arbitration panels violate this right.

Think, but do not be discouraged. Be informed. Be prepared. Be an educated consumer.

You CAN achieve fair compensation for your injuries and beat the insurance industry at their own game. But it may take time, effort and patience.

Share This